Bulletin 3425

Bulletin E-3425 Loans & Security: An Introduction to Farm Collateral

DOWNLOAD

June 23, 2022 - Jonathan LaPorte, MSU Extension

Managing a farm involves investing time and money toward creating a successful business. Of these investments, having enough money to cover farm needs or offset losses is a concern for beginning farmers. A common resource for new managers to obtain money, or cash, is by seeking a loan from a farm lender (creditor).

A loan is not simply a source of funds, but an investment in your farm business and its plans for success. By providing funds, lenders help to reduce risk concerns that a lack of cash can create. A loan helps to secure your ability to pursue production goals. However, by ensuring your ability to operate, a lender takes on an amount of your farm’s risk from potential losses. For lenders to agree to such investments, they need to offset their risk concerns.

The primary risk concern to lenders is nonpayment by a farm due to limited cash. A lender will approach reducing their concerns in a way similar to that of a farmer, by pursuing risk management options. The best form of risk management for a loan is for the lender to secure an interest in your farm’s collateral.

Throughout this publication, we will review basics of securing a loan and how to identify collateral on your farm. We will also review how managing available collateral can reassure lenders investing in your business. These reviews will include explanations of key phrases or technical terms frequently used in discussions of farm collateral.

What Is Collateral?

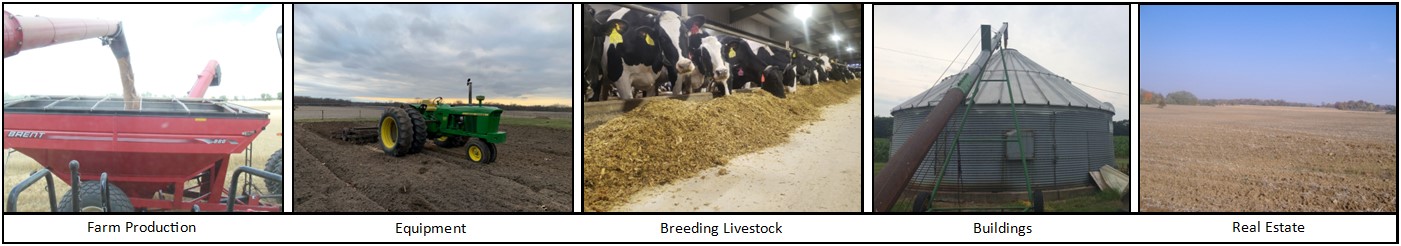

Collateral is a term that describes assets that serve as a second source of funds to secure repayment of a loan. Collateral is used as a backup source of repayment when a loan is considered to be in default. Default is a term used to describe when a borrower avoids or evades repayment. If a loan is in default, assets are obtained and sold to protect against potential losses. Also called loan security, collateral can be any farm or personal asset available to a lender. The most common types of assets used are farm production, equipment, breeding livestock, buildings, and real estate.

Farm Production

Farm production describes final products raised or created for sale. Crops and mature livestock (such as beef or pigs) are common examples of farm products. Honey, milk, Christmas trees, flowers, nursery plants, and young livestock can also be considered farm production.

Equipment

Equipment describes all mechanical structures or devices owned by a farm business and used in production practices. Equipment can include hand tools, tractors, trailers, all-terrain vehicles, and even planting or tillage implements. Structures that are not physically attached to real estate may also be described as farm equipment.

Note: Farm production and equipment can also be grouped together and referred to as chattels. Chattels describe tangible or physical assets that are not real estate property.

Breeding Livestock

Breeding livestock are considered separate types of collateral from livestock raised for sale. These animals are kept beyond a production cycle often for five years or more. Breeding livestock produce livestock for resale, potential replacement breeding livestock, or farm products to be sold within a production cycle.

Buildings

Buildings can be any structure or facility used in fundamental operations of a farm business. These can include storage buildings, grain bins, feed bunkers or silos, milk parlors, or livestock free-stalls. Buildings, if not fixed to real estate, may also be considered chattels. Fixed buildings are a unique form of collateral that can be secured using either a financial statement or mortgage. Most creditors consider fixed buildings to be part of real estate and prefer to use a mortgage.

Real Estate

Real estate describes a parcel of land, or a building or structure affixed to a parcel, which is used for farm production. To be considered farm real estate, parcels of land must be used to raise one or more agricultural commodities or products. There may also be minimum requirements of acreage or receipts of production sold to qualify as farm real estate. These requirements are dependent on local government ordinances.

Normal Income vs. Basic Loan Security

Collateral is often described as either normal income or basic loan security.

Normal income security includes anything produced or grown to be sold. Farm production such as crops, livestock, or livestock products are common examples of normal income security.

Basic loan security includes all assets used to operate a farm business. Types of assets include farm equipment, breeding livestock, buildings, and real estate.

Matching Useful Life of Collateral to Loan Terms

An important aspect of obtaining a loan is whether you have assets that will exist throughout a loan’s repayment period. To ensure loan security, creditors will seek assets that have a useful life similar to a loan’s expected lifetime or terms.

A useful life is an estimate of how long an asset remains in service and cost-effectively generates revenue. The two key phrases of defining useful life are “remains in service” and “cost-effectively generates revenue.”

Assets such as farm equipment and buildings tend to require general maintenance or repair each year. As these types of assets age, repairs can become more frequent or significantly more expensive. When considering whether to make repairs, farm managers will weigh whether costs outweigh an asset’s production value.

The same concept is used with breeding livestock. There may be a reduction in pregnancy rates, decreases in offspring health, or concerns of an older animal’s health when producing offspring. The production levels of milk-producing animals will begin to decrease as they age. In all of these scenarios, production values begin to reduce while annual costs may not change or are increased.

An asset is considered to be cost-effective as long as revenue generated is more than its costs to use or keep in service. That same asset remains in service for as many years as it is able to be cost-effective. Once an asset has reached a point where its costs are higher than any revenue it generates, it is replaced. Understanding an asset’s useful life, or when it will be replaced, helps determine which type of loan it best secures.

Table 1. Common Useful Life Estimates on Farm Assets

|

Farm asset |

Cost-effective years in service |

|

Farm production |

12–18 months |

|

Breeding livestock |

3–10 years |

|

Farm machinery |

5–10 years |

|

Buildings |

7–25 years |

|

Real estate |

Infinite (does not age) |

The Internal Revenue Service also provides a listing of recovery periods for taxable depreciation on farm assets. These recovery periods are another example of useful life estimates that can be used for both income tax and loan security purposes. For more information, view Table 7-1. Farm Property Recovery Periods at: https://www.irs.gov/publications/p225#en_US_2021_publink1000177268.

Production vs. Capital Loans

The types of assets used as collateral also depends on which type of loan is being requested. The most common forms of loans are made for either production or capital investments.

Production Loans

Production (or annual operating) loans are intended to be repaid after one production cycle. A production cycle typically lasts for 12 to 18 months depending on when intended farm products are sold. These loans are considered to be self-liquidating (pays for itself) because they use farm production, or normal income security, as their source of collateral.

Farm production is held as collateral because of how borrowed money is used. Production loans help purchase livestock for resale or resources commonly called farm inputs. Farm inputs can include chemicals, feed, fertilizer, seed, or other supplies. These resources are used as ingredients to create commodities or other products for sale. Once used by a farm, resources are no longer available to be resold to ensure loan repayment. Commodities and farm products are often sold at the end of a cycle, making proceeds from sales available to repay a loan.

Capital Loans

Capital (or term) loans are intended to be repaid over a longer period of time. These loans provide funds for purchases of capital assets used in farm production. Those assets can include breeding livestock, equipment, facilities, or real estate. Capital loans are often grouped into two categories: short term or long term.

Short-term, or intermediate, loans are intended to be repaid within 5 to 10 years. These loans provide funds primarily to purchase livestock or farm equipment, which serves as a primary source of collateral. Breeding livestock and equipment still exist after final products are produced. These assets can be sold, and funds used to repay a loan. However, these types of assets eventually age, become less productive, and need to be replaced.

Long-term loans are intended to be repaid within 20 to 40 years. These loans provide funds for land or buildings to be placed on land. The primary source of collateral for these types of loans is typically only land. Buildings may be used to secure a loan if they are easily removed from land. In most cases, putting up a building fixes them to land, making removal difficult.

Note: Values of buildings and land are tracked separately on a balance sheet. Similar to farm equipment and livestock, buildings age and in time need replacing. Land does not age and is not considered replaceable.

Securing Collateral to a Loan

The act of securing collateral involves establishing a lien, or a legal claim over an asset. These claims outline how assets can be obtained and sold to repay existing debts. The agricultural industry uses two main types of liens: agricultural and security interest liens.

An agricultural lien is a type of lien in which a state law allows the lien to be placed without permission from a borrower. Creditors obtain a lien against an individual’s property by filing a financial statement. A financial statement outlines how a creditor’s loan is related to purchased farm assets. It grants a creditor permission to establish a claim against farm assets. Agricultural liens do not require a borrower’s consent to be filed. They are common when farm inputs are purchased on credit. Credit is when purchases are made with a promise to be paid later.

A security interest is a type of lien in which a lender and borrower enter into a voluntary security agreement. A security agreement is a signed financial statement that grants permission for a claim against farm assets. Security interest liens are common for agricultural lenders. These creditors provide funds to purchase production or capital assets. They are not manufacturers or providers of services common to agricultural liens. As providers of funds, they must have consent of a borrower to establish a claim on their farm’s assets.

Real estate loans are also secured with a type of security interest lien. Similar to a financial statement, a mortgage is a signed security agreement that grants permission for a claim on a farm’s land assets.

Liens on all assets, except real estate, are governed by Article 9 of the Uniform Commercial Code. Article 9 defines which types of collateral, how they can be secured, and which claim on farm assets has first priority. Mortgages follow a similar framework to Article 9 with regard to lien positions on assets.

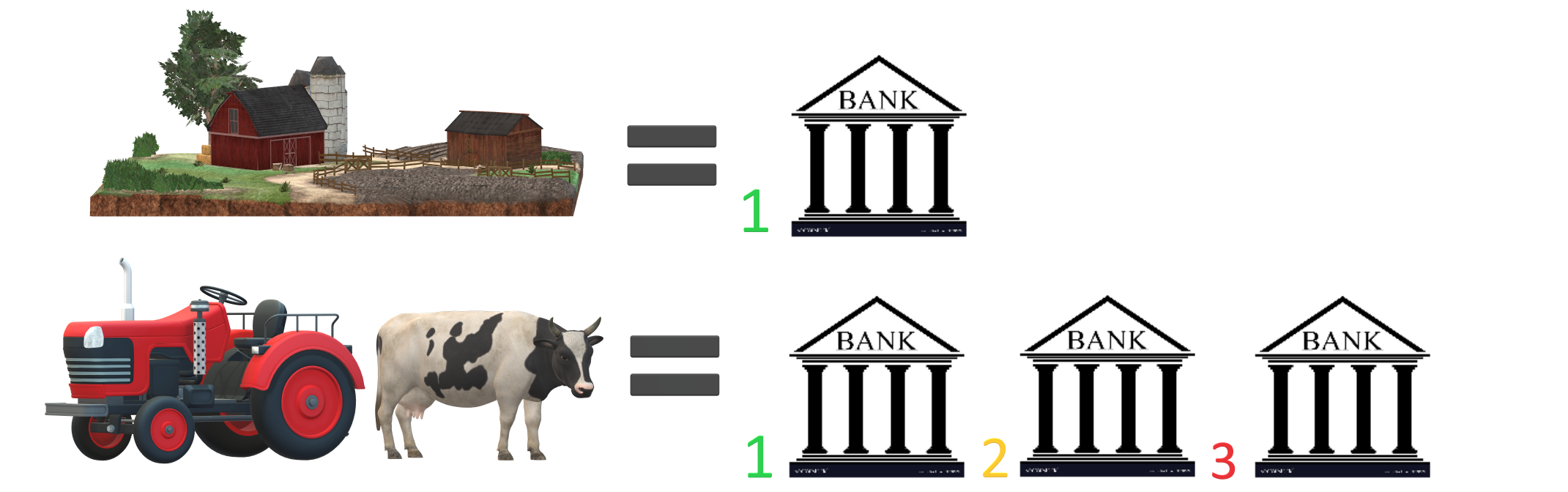

Lien Position

Farm assets can have more than one lien placed against them. Different creditors can each have their own lien on an asset. The same creditor can likewise file multiple liens, if needed, for different loans. The number of liens is an important consideration of any proposed loan. The fewer liens that exist means more assets are available to protect a loan investment. A large number of liens makes it more difficult for a creditor to feel confident a loan can be secured.

Equally as important as how many liens exist is what priority, or position, they are in.

First (1st) position lien – A creditor with a lien, or lienholder, prefers to have a first (1st) position lien. These claims on farm assets offer more security and less risk. A first position is considered a first right to any funds from sales of collateral. This right to funds is important when multiple creditors are using the same collateral to secure loans. A first lien ensures all funds go toward full repayment of a first lienholder’s loan even if a loan is up to date and all scheduled payments with a first lienholder have been made.

For example, a borrower has a loan with Creditor A of $10,000 and with Creditor B of $15,000. The borrower has made all of their scheduled payments with Creditor A. However, no payments have been made to Creditor B in over a year. Creditor B declares the borrower’s loans to be in default. Farm collateral is acquired and sold for repayment, generating $15,000. Creditor A and Creditor B both have a lien on farm assets, but Creditor A has a first lien. Even though Creditor A has received scheduled payments, their lien gives them a first right to funds from any sales of collateral. Therefore, sales proceeds of $10,000 are paid to Creditor A to repay their loan. The remaining $5,000 is then made available to Creditor B, if their lien has next highest position compared to any other existing liens.

Date and time of lien perfection is what determines position. Article 9 outlines a first-to-file rule that establishes lien position based on a financial statement’s filing date. However, many state laws extend this rule to also include agricultural liens. In Michigan, if an agricultural lien is perfected before a security interest is filed, an agricultural lien holds first lien position. The security interest lien will hold a second (2nd) or subsequent lien position.

Subsequent lien positions – Creditors who are unable to obtain a first position lien take on more risk. Their loans must rely on additional collateral value remaining after a first lienholder’s loan is repaid. This makes loans with only subsequent lien positions less secure. These types of liens are common in production loans or when capital loans require additional security.

Additional Security

Creditors typically require loan security be provided at values greater than a proposed loan amount. In our previous section, we discussed how existing liens and lien position may make a creditor less secure. In addition to existing liens, there are several other reasons why added collateral may be needed:

Farm production is valued based on an estimated price. Total production is often not fully priced until delivered to an intended market. Even with market contracts, there is some level of risk that production will be sold for less than expected. Production yields may also be lower than estimated, leaving total revenue below expected levels to repay a loan.

Purchased assets may be fixed to other farm assets and difficult to separate. Buildings or facilities are considered fixtures or permanent attachments to real estate. To perfect a lien on these types of assets, a lien must also be taken on real estate. This presents a situation where both a security agreement and mortgage may need to be filed to fully secure a loan.

Creditors may be asked to subordinate their lien position to another creditor. In a subordination, a lienholder in a higher lien position agrees to move into a lower lien position. A request to move lien positions is often made to a first lienholder. A common example is to allow another creditor to obtain a first lien on a specific farm asset or group of assets. The creditor requesting a subordination typically is making a new loan to a farm and needs security for approval.

Purchased farm assets may need replacing before debt can be repaid. As equipment, livestock, and buildings age, their production value to a farm will decrease. Once these types of basic security reach a low enough production level, they are replaced. Replacement typically involves selling older assets and using sale funds toward purchase of newer, more productive assets. However, when replacement happens prior to full loan repayment, a creditor’s lien can create a difficult scenario of where funds should go. Because a lien establishes a first right to funds, they should go to a creditor to put toward a loan. However, a farm would prefer to use sale funds to help reduce costs of purchasing a new asset. Often, lenders are agreeable to a farm’s intended use of funds but want to maintain security after collateral has been replaced. The use of added collateral can ensure loan security is maintained. At the same time, creditors can allow a farm to reinvest sales funds into a newer asset.

Recognizing these scenarios can exist, creditors will often perfect a lien on additional loan security.

Liens on Additional Security

Perfecting a lien on additional security requires establishing new liens or ensuring conditions are present in existing liens. Of these options, filing a new lien can present additional risks for both a creditor and borrower.

Filing a new security agreement can take time. Time is valuable to a manager looking to use newer productive assets on a farm. Certain capital assets may be available only for a certain time period. If that period elapses before a security agreement can be filed, a farm manager may lose out on a replacement asset.

For example, a local equipment dealer has a chemical sprayer that would be ideal for your fruit orchard. The dealer is willing to take your existing sprayer in on trade to make the new purchase affordable. However, pending sales can only be held for two days. The sprayer will then be available to other buyers, so you must act quickly. Your lender has a lien on your existing sprayer. They agree to use a different asset of equal or greater value so long as it has no existing liens. It takes three days to identify a tractor of equal value will work. Your lender works quickly to perfect a new lien. However, after arriving at your equipment dealer that same afternoon, you learn that someone else has purchased the sprayer.

Time is also valuable to a creditor’s ability to obtain a satisfactory lien position. If filing a new lien takes too long, there is a possibility that another creditor could perfect a lien with a higher priority. Using our previous example, if a different lender had filed a lien on your tractor first, you would need to find a new asset to offer your first lender. Creditors with existing loans do not want to be in a long line of lienholders, especially on additional security.

A more effective method of obtaining a lien on additional collateral is to include conditions within security agreements. The most common conditions are blanket liens and hereafter acquired clauses.

In a blanket lien, a creditor takes a lien on all assets of a similar type instead of listing a single, specific asset. This is the most secure type of lien that a creditor can file. A blanket lien ensures that a creditor will maintain its lien position regardless of liens filed by other creditors.

A hereafter acquired clause states that assets obtained after a security agreement is signed will serve as collateral. This type of clause is helpful when replacing assets that already have a pre-existing lien. The new asset has an identical lien position to an asset it replaces and maintains a creditor’s loan security.

A hereafter acquired clause is often included with a blanket lien to provide maximum loan security.

Estimating Collateral From Financial Statements

A balance sheet can be a helpful way to understand what assets you have to offer as collateral. This financial statement will list creditors but not liens or their positions. While a balance sheet does not list these types of information, it does offer indicators of security potential. When combined with an income statement, these financial documents can calculate ratios used in evaluating collateral on your farm. These ratios include rate of return on assets, rate of return on equity, and debt to asset.

Rate of return on assets is viewed as an average interest rate being earned by investments in a farm. Farms with outstanding loans use both their own cash and funds obtained from creditors. That means that investments made in a farm are shared by creditors and farm owners. A higher rate of return means that a farm manager is using both sources of funds effectively to create profits. It is calculated as:

|

Rate of Return on Assets (ROA) Return on Assets ÷ Average Farm Assets |

|

(Return on Assets = Net Farm Income + Interest Expense – Value of Operator Labor & Management) |

Note: Operator labor and management is an opportunity cost that represents unpaid labor and management by farm operators.

Rate of return on equity is viewed as an average interest rate being earned by your investments in a farm. A higher rate of return means that a farm is using its own source of funds effectively to create profits. When compared to returns on assets, this ratio will be lower if there are any outstanding debts. If significantly lower than return on assets, ratio implies that a farm is highly leverage or dependent on creditor financing to operate. The ratio is calculated as:

|

Rate of Return on Equity (ROE) Return on Farm Equity ÷ Average Farm Net Worth |

|

(Return on Farm Equity = Net Farm Income – Value of Operator Labor & Management) |

Note: Operator labor and management is an opportunity cost that represents unpaid labor and management by farm operators.

Creditors use rate of return ratios together to help them better understand several areas of a farm business. For example, if there is a higher rate of return on assets, it suggests efficient use and management of assets to generate income. If there is also a lower rate of return on equity, it implies a large amount of debt. That debt may be consuming income, leaving few assets to secure new loans. A debt to asset ratio is then used to confirm a farm’s collateral potential.

Debt to asset is viewed as a creditor’s share of a farm business. It provides a quick view of how many farm assets are tied to outstanding loan dollars or debt. A high ratio indicates greater financial risk and signifies a lower borrower capacity. It is calculated as:

|

Debt To Asset (D/A) Total Farm Liabilities ÷ Total Farm Assets |

Collateral isn’t simply about how many assets are free to use against loan debt. As these ratios indicate, creditors can start to develop a picture of a farm’s performance and overall financial health. A comfortable investment is a farm that effectively uses all sources of funds to generate income and maintains low debt levels. Lower debt levels provide more collateral to secure funds that are borrowed routinely from a creditor.

Recommendations

It’s not always necessary for a farm to acquire a loan. Loans can be a beneficial resource for helping to get your operation started but should be entered into with caution as loans must be repaid. Your farm’s repayment ability is an area we’ll discuss in a later publication.

As a farm manager, if you decide to obtain a loan, you should understand which assets can be used for loan security and what liens are held by current creditors. Your ability to borrow funds depends greatly on how secure a lender feels about an investment in your operation.

Start by getting comfortable developing and creating your farm’s financial statements. Emphasize understanding farm assets and debts on your balance sheet. Keep in mind that asset values should reflect true market value, not necessarily what you think it should be worth. Identify debts and their lien positions on your farm assets. Next, prepare your farm income statement and use financial ratios to evaluate collateral on your farm. Identify how well your farm performs when using sources of funds to create profit and manage overall debt.

The most important and final step is being able to comfortably talk about available security. Knowledge is valuable, but so is being able to relay that information to a potential creditor. Familiarize your ability to secure a potential investment both now and in the future as your operation grows. Review how you are managing security to ensure that funds for operating can remain secure even as capital purchases are being made.

Your farm’s growth depends on your ability to be aware of many aspects of operating a business. Obtaining loan funds to operate with is often one of the most challenging. Understanding your farm’s collateral is just one way to help lenders feel comfortable that any risk of investing in your farm is reasonable and worth taking.

Print

Print Email

Email